If you’ve ever stared at a pregnancy test, then your bank account, and felt a wave of panic wash over you, trust me, mama, you arenotalone. The thought of diapers, doctor's visits, and, well,everythinga new baby needs can feel overwhelming when you're already juggling bills and trying to eat healthy (those cravings add up!). I remember those sleepless nights all too well, wondering how we’d possibly make it all work.

But here's the thing: Youcando this. Financial planning during pregnancy doesn’t have to be some scary, complicated ordeal. It's about taking small, manageable steps that add up to big peace of mind. Even just starting with one tiny tweak can make a world of difference.

So, let’s start small, okay? I want you to find a jar – any jar will do. Maybe it’s an old pickle jar, a mason jar, or even a piggy bank. Label it "Baby Fund." Now, every single day, I want you to putsomethingin that jar. It could be a dollar, spare change from your purse, whatever you can manage. You’d be surprised how quickly those little bits add up. Seriously, it's like magic (or, you know, math). And it’s a tangible reminder that youareactively preparing for your little one.

Budget-Friendly Pregnancy Hacks That Actually Work

Okay, let's dive into some real, actionable strategies to help you navigate pregnancy without emptying your savings account. These aren't just theoretical tips; they’re the hacks that actually helped me (and countless other moms) survive and thrive during pregnancy.

1. Nail Down Your Health Insurance – ASAP!

This is, without a doubt, themostimportant thing you can do. Understanding your health insurance coverage is crucial for managing pregnancy and childbirth costs. Don't put this off!

Call your insurance company: Ask detailed questions about what's covered, what your deductible is, and what your out-of-pocket maximum is. Specifically ask about prenatal care, delivery (vaginal vs. C-section), and postpartum care. Get the names of the representatives you speak with and keep detailed notes of your conversations. Understand your plan: Is it an HMO, PPO, or POS? Each type of plan has different rules about seeing specialists and accessing care. In-network vs. Out-of-network: Staying in-network will save you atonof money. Make sure your OB-GYN and the hospital you plan to deliver at are in your network. Consider supplemental insurance (if needed): If your current plan has high deductibles or limited coverage, look into supplemental insurance options. But be careful and do your research – make sure the cost of the supplemental insurance doesn't outweigh the potential benefits. A healthcare marketplace navigator or benefits specialist may be able to offer advice. Medicaid and CHIP:If you qualify, these programs can provide comprehensive coverage at little or no cost. Don't hesitate to apply – they are there to help!

Don't be afraid to be a pest! It's your right to understand your coverage, and asking questionsnowcan prevent nasty surprises later.

What if I don't have health insurance?

Healthcare Marketplace: Explore the options available on the Healthcare Marketplace. You may qualify for subsidies that significantly lower your monthly premiums. Community Health Centers: These centers offer affordable care on a sliding scale based on your income. Medicaid:As mentioned above, Medicaid provides coverage to low-income individuals and families. Pregnancy is a qualifying event that can make you eligible.

2. Create a Realistic Budget (and Stick To It!)

Okay, I know, budgeting isn't exactlyfun. But trust me, it’s essential for pregnancy financial planning.

Track your spending: Use a budgeting app (like Mint or YNAB) or simply a spreadsheet to track where your money is going for a month. You might be surprised at what you find! Identify areas to cut back: Be honest with yourself. Are there subscriptions you're not using? Can you eat out less often? Even small changes can make a big difference. Create a baby-specific budget: Estimate the costs associated with having a baby (diapers, formula, clothes, gear, etc.). There are tons of free baby cost calculators online! Prioritize needs vs. wants: This is a big one. Yes, that fancy stroller looks amazing, but do youreallyneed it? Focus on the essentials first. Set realistic goals:Don't try to cut back too much too quickly. Start small and gradually make changes over time.

3. Embrace the Secondhand Market

This is where you canreallysave some money. Babies grow out of things so quickly, so buying new isn't always necessary.

Thrift stores: Check out your local thrift stores for gently used baby clothes, toys, and even some baby gear. Consignment shops: These shops specialize in selling used baby and kids' items. They often have higher-quality items than thrift stores. Online marketplaces: Facebook Marketplace, Craigslist, and Offer Up are great places to find deals on everything from cribs to strollers. Mom groups: Join local mom groups on Facebook or other platforms. Moms are always looking to get rid of gently used baby items. Hand-me-downs:Don't be afraid to ask friends and family members if they have any baby items they're no longer using. Most parents are more than happy to pass on their outgrown items.

When I was pregnant, I scored a practically brand-new bassinet on Facebook Marketplace for a fraction of the retail price. It was a lifesaver!

Is it safe to buy used baby gear?

Check for recalls: Before buying any used baby gear, check the Consumer Product Safety Commission website (cpsc.gov) to see if it has been recalled. Inspect the item carefully: Look for any signs of damage or wear and tear. Make sure all parts are functioning properly. Clean thoroughly:Wash all used baby clothes and gear before using them.

4. Stock Up Strategically (But Don't Overdo It)

It's tempting to buy everything you think you'll need before the baby arrives. But trust me, you don't need to go overboard.

Create a registry: Even if you're not having a baby shower, creating a registry can help you keep track of what you need and what you already have. Plus, many stores offer completion discounts on items remaining on your registry after your due date. Take advantage of sales and coupons: Sign up for email lists from baby retailers and follow them on social media to stay informed about sales and coupons. Buy in bulk (for certain items): Diapers and wipes are good items to buy in bulk, especially when they're on sale. Don't buy too many newborn clothes: Babies grow out of newborn clothes incredibly quickly. Stick to a few basic outfits and wait to see how big your baby is before buying more. Borrow before you buy:See if you can borrow certain items (like a baby swing or bouncer) from friends or family members before buying them yourself. Your baby might not even like it!

5. Get Creative with Maternity Clothes

You don't need to spend a fortune on a whole new wardrobe.

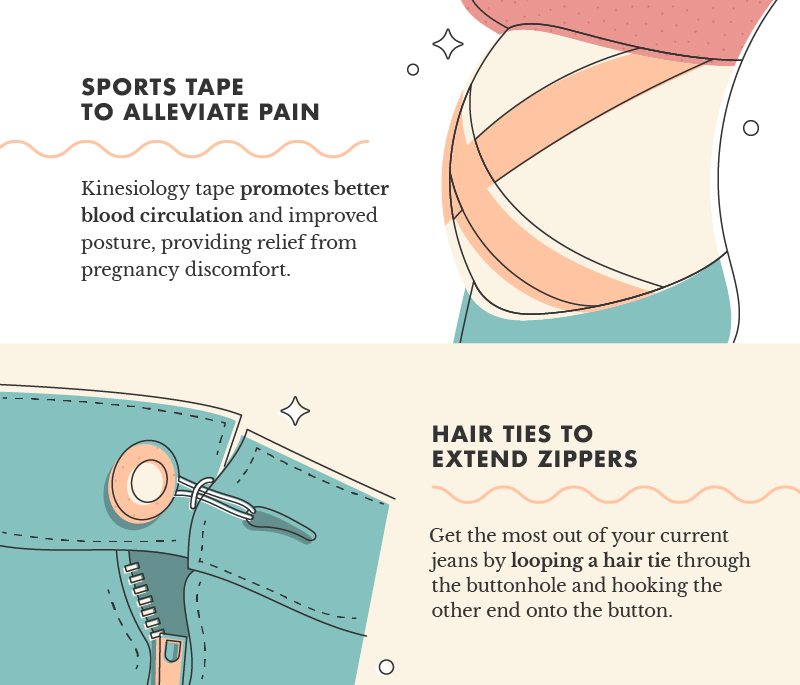

Shop your closet: Look for clothes that are stretchy and comfortable. Leggings, oversized sweaters, and flowy dresses are your friends. Borrow from friends: Ask friends who have been pregnant if you can borrow some of their maternity clothes. Buy a few key pieces: Invest in a good pair of maternity jeans, a comfortable maternity bra, and a few basic tops that you can mix and match. Thrift stores and consignment shops: You can often find gently used maternity clothes at thrift stores and consignment shops. Rent maternity clothes:Some companies offer maternity clothes rental services, which can be a great way to save money and try out different styles.

When I was pregnant, I lived in leggings and my husband's oversized t-shirts. Comfortable and budget-friendly!

6. Breastfeed (If Possible)

Breastfeeding is not only beneficial for your baby's health, but it can also save you a significant amount of money on formula.

Take a breastfeeding class: Educate yourself about breastfeeding before the baby arrives. This can help you avoid common problems and increase your chances of success. Get support: Join a breastfeeding support group or find a lactation consultant who can provide guidance and support. Invest in a good breast pump (if needed): Many insurance companies cover the cost of a breast pump. Contact your insurance company to find out what's covered. Learn about pumping and storing breast milk: This will allow you to pump and store breast milk for later use, even if you're not always available to breastfeed directly.

I know breastfeeding isn't for everyone, and that's okay! But if you're able to breastfeed, it can save you a lot of money on formula.

What if I can't breastfeed?

Look for formula coupons and discounts: Sign up for email lists from formula manufacturers and follow them on social media to stay informed about sales and coupons. Consider generic formula: Generic formula is often just as nutritious as brand-name formula but costs significantly less. Talk to your pediatrician before switching to generic formula. Join formula-sharing groups:There are online groups where parents share unused or extra formula.

7. Plan for Maternity Leave (and Beyond)

Maternity leave can be a challenging time financially, so it's important to plan ahead.

Understand your company's maternity leave policy: Find out how much paid leave you're eligible for and how long you can take unpaid leave. Save as much money as possible before your leave: Start saving early and try to cut back on unnecessary expenses. Explore government benefits: You may be eligible for unemployment benefits or other government assistance programs during your maternity leave. Create a post-maternity leave budget: Consider childcare costs, transportation expenses, and other costs associated with returning to work. Consider a side hustle:If you're looking for ways to supplement your income, consider starting a side hustle that you can do from home.

When I was on maternity leave, I sold handmade baby items on Etsy. It wasn't a huge income, but it helped!

How much should I save before baby comes?

This depends on your individual circumstances, including your income, expenses, and maternity leave benefits. As a general rule, it's a good idea to have at least 3-6 months' worth of living expenses saved before the baby arrives.

What's the biggest pregnancy expense?

For most families, the biggest pregnancy expenses are childbirth and childcare. These costs can vary widely depending on your insurance coverage, the type of delivery you have, and the type of childcare you choose.

You’ve Got This, Mama!

Remember, mama, you don't have to do it all perfectly. Every little bit you save, every small step you take, makes a difference. Don't compare yourself to other moms who seem to have it all figured out. Focus on what youcancontrol, and celebrate your successes, no matter how small. It’s okay to feel overwhelmed, but don’t let the financial anxieties overshadow the joy of welcoming your little one. You are strong, capable, and resourceful. Trust your instincts, take things one day at a time, and know that you’ve got this! We’re all in this together, one budget-friendly baby step at a time.